Our Founding Story

Our Founder and Managing Partner Maurice Ng immigrated to the U.S. from Hong Kong with his family with nearly nothing in 2008. He spent the next 10 years learning English, attending college, and working his way up the corporate ladder. During the height of the pandemic, he left his job in Silicon Valley to start Tings Capital, a venture capital fund investing in “The Underdogs” entrepreneurs. Here’s how Ng plans to give back to “The Underdogs”.

In Partnership With

Maurice Ng

Maurice Ng (Ng Hong Nin 吳康年) is the Founder and Managing Partner at Tings Capital, where he focuses on leading and directing all investment and operational activities of the firm.

Previously, Mr. Ng was a Strategic Finance Partner/ Chief of Staff equivalent at Momentive Global (f.k.a. SurveyMonkey), where he was responsible for managing company-wide global business operations and strategy. Before Momentive Global, Mr. Ng was a Private Equity and Growth Equity Investment Professional at Farol Asset Management, LP, a minority-owned lower-middle-market investment firm based in New York City. At Farol, Mr. Ng was responsible for due diligence and monitoring investment opportunities across all industry sectors. Before joining Farol, Mr. Ng was an Investment Banker at J.P. Morgan.

Mr. Ng received a degree in Bachelor of Business Administration in Finance and Investment from Baruch College Zicklin School of Business, and a Master of Business Administration from Stanford University Graduate School of Business.

Advisory Board

-

Peter Borish

Co-Founder of Tudor Investment Corp.

Chairman & CEO of Computer Trading Corp.

Founding Board of The Robinhood Foundation

-

Marquiith Crawford

Head of Caterpillar Ventures

Managing Director of Stanley Ventures

Managing Director of Intel Capital

-

Brian Devine

Chairman Emeritus of the Board at PETCO

President of Toys “R” Us

-

Felipe Fernandez

CIO of Grupo Modelo Family Office

President of Sistema B

President of AS Alimentaria

-

Ken Goldman

President of Hillspire Capital (Eric Schmidt Family Office)

CFO of Yahoo

CFO of Fortinet

-

Sean Koh

CIO of Koherent Family Office (HDMI Technology Inventor)

-

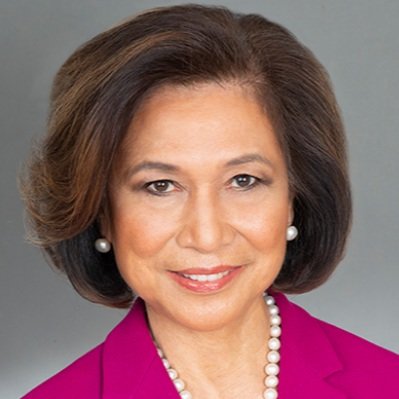

Loida Lewis

Chairwoman of The Reginald F. Lewis Foundation

Chairwoman & CEO of TLC Beatrice, LLC

-

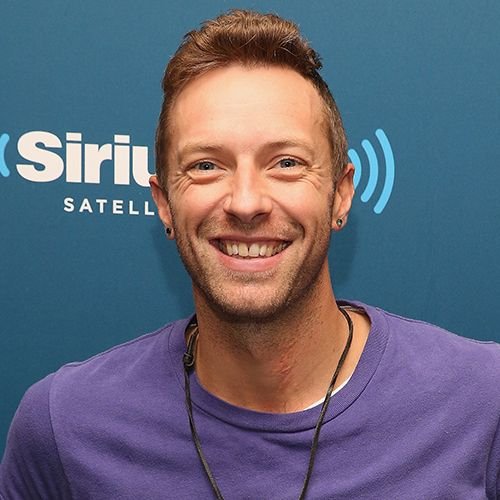

Chris Martin

Lead Singer of Coldplay

Co-Founder of Outlyer Entertainment

-

Danielle Maybach

Executive Director of The Maybach Foundation

CEO of Eva Gardens Marketing

-

Alex Ok

CIO of Forever 21 Family Office

Co-Founder & CEO of Valex Solutions

-

Benny Pough

President of Roc Nation

EVP of Epic Record

SVP of Def Jam Recordings

-

Robert Rosenberg

Managing Director of Prolog Ventures

Partner of New Venture Partners

Head of Venture Investment of Nokia

Partner of Boston Consulting Group

-

Todd Ruppert

President & CEO of T. Rowe Price

CEO of Ruppert International

-

Consuelo Vanderbilt

7th Generation Heiress of The Vanderbilt Family

Founder & CEO of Sohomuse

Advisory Board of Forbes

-

Metta World Peace

NBA Champion

Chairman of Artest Management Group

-

Roxanna Zarnegar

COO of Christie’s America

CIO of Provenance Capital

Our Cultural Value

01 - Family

We are family. We support and make each other better - there is no place for ego.

02 - Communication

We believe in over-communication and transparency.

03 - Process

We believe process is religion.

04 - Data-Driven

We make decisions based on quantitative and qualitative data.

05 - Long-Lasting Value

We believe in building substantive values that last.

06 - Relationships

We cultivate healthy relationships and believe character is everything.

07 - Ambitions

We have high ambitions - the sky is NOT the limit.

08 - Journey

We enjoy the little things in life.

09 - Dedication

We dedicate our lives to making the world a better place.